2026 is shaping up to be a year of balance for multifamily real estate. After years of record deliveries and shifting markets, opportunities are emerging for disciplined investors.

8

min read

By

As we enter 2026, commercial real estate (CRE), particularly multifamily, continues its transition following a period of elevated construction activity, shifting capital markets, and uneven rent growth across U.S. metros. While recent years brought volatility, the year ahead appears positioned for greater balance as supply moderates, demand stabilizes, and capital begins to re-engage.

At Wilkinson, we remain focused on disciplined acquisition strategies and proactive asset management to deliver value to our investors. With decades of experience navigating cycles, we are positioned to capitalize on opportunities that 2026 will offer while managing downside risks.

Key areas of focus:

Commercial Real Estate Outlook for 2026

Multifamily Rent, Vacancy, and Supply Dynamics

Capital Markets and Financing Conditions

Political & Economic Considerations

Wilkinson’s Target Market Outlook

Strategic Positioning in a Balanced Market

Commercial & Multifamily Outlook for 2026

Rent Growth Moderates but Remains Positive

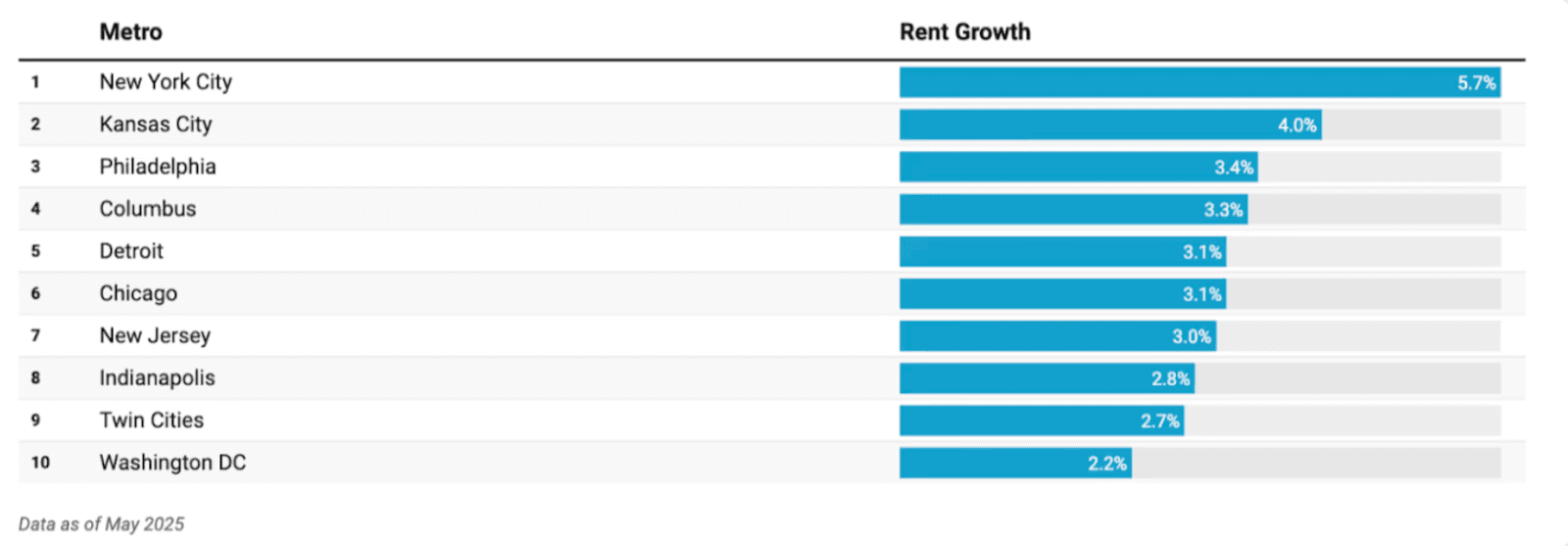

National multifamily rent growth is projected to range between 1.2% in 2026 (CREDaily, Multifamily Outlook 2026). While this represents a slowdown from post-pandemic highs, growth remains positive, particularly in metros supported by population growth, employment expansion, and relative affordability.

The era of broad-based, rapid rent growth has passed, but fundamentals remain intact. Performance is increasingly market-specific, with select Sun Belt and Midwest metros continuing to outperform national averages.

Investments have increased in markets such as Atlanta and Dallas-Fort Worth (CREDaily).

Smaller, value-oriented markets like Indianapolis are experiencing steady, sustainable increases due to limited new supply.

Source:https://crowdstreet.com/resources/economic-trends/multifamily-rent-growth-2025-cre-trends

Why this matters: In a moderating growth environment, operators can no longer rely on rent inflation alone. Returns are driven by unit upgrades, operational efficiencies, and active asset management, reinforcing the importance of experience and execution.

Looking ahead: As supply continues to slow, modest rent growth combined with operational improvements can still translate into meaningful long-term value, particularly in markets with durable demand drivers.

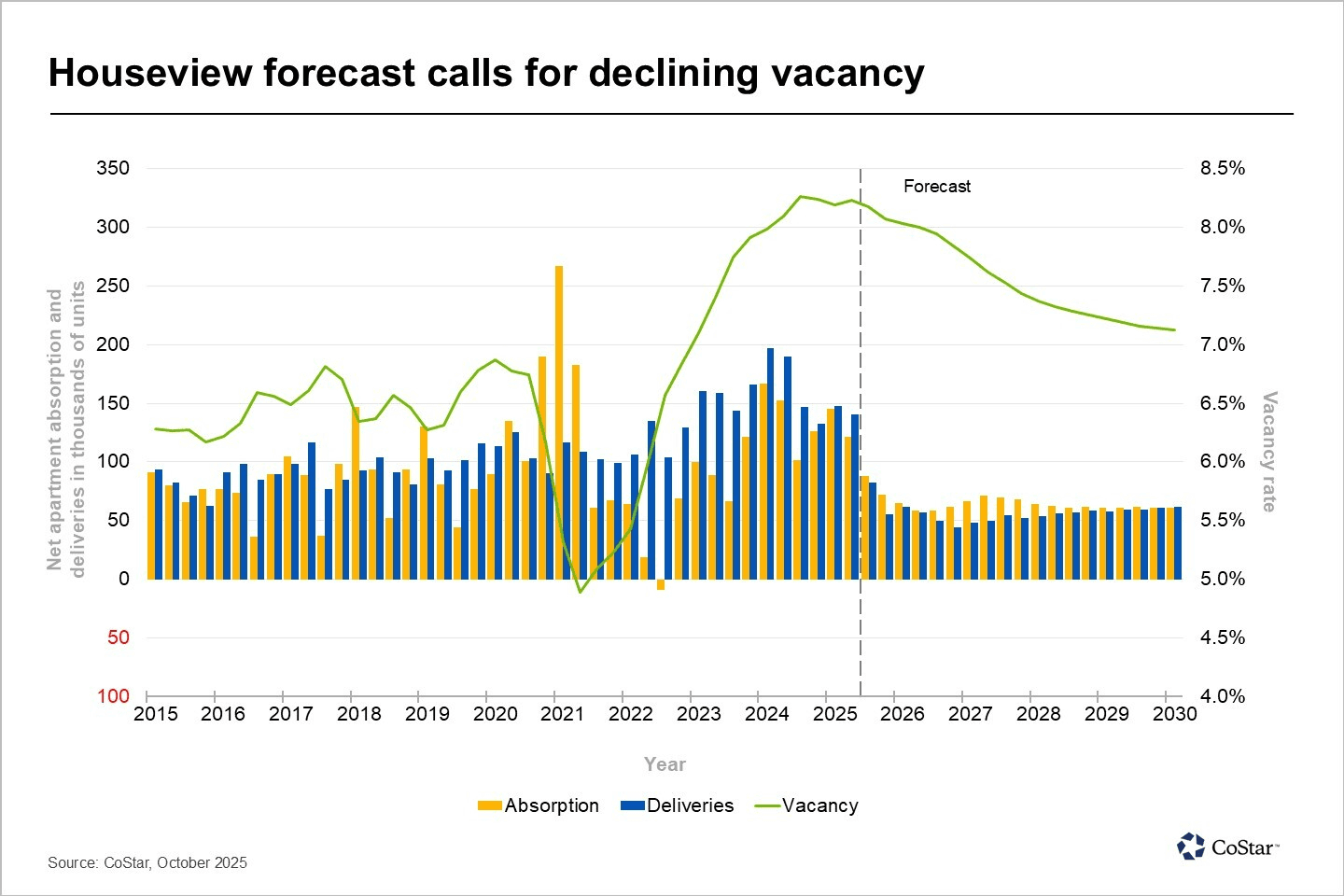

Vacancy Pressures Easing, Opportunities Ahead

National multifamily vacancy is projected to average approximately 7.9% by year-end 2026 (CoStar), largely reflecting the aftereffects of prior construction booms.

While vacancy is projected to decline in many markets due to the high delivery levels of recent years, performance varies widely by metro. New construction is slowing, allowing absorption to gradually catch up in high-demand markets.

Source: https://www.costargroup.com/press-room/2025/costar-lowers-near-term-us-multifamily-forecast

Deliveries are decelerating across most major metros.

Strong absorption trends are evident in Dallas-Fort Worth where demand continues to outpace new supply.

Why this matters: Stabilizing occupancy supports predictable cash flows and reduces reliance on aggressive leasing assumptions, an essential factor for long-term investors navigating a balanced market.

Looking ahead: As construction pipelines continue to thin, vacancy rates are expected to gradually compress, particularly in markets with strong job growth and population inflows.

Capital Markets & Financing Conditions

After a period of muted activity, CRE transaction volume is expected to increase 15–20% in 2026, supported by pricing stabilization and renewed investor confidence (Colliers, Commercial Real Estate Outlook, 2026).

Capital is returning to the market, but underwriting remains disciplined. Financing is available for well-structured deals in strong markets, favoring experienced operators.

Lenders continue to prioritize conservative leverage and durable cash flow.

Structured solutions such as mezzanine debt and preferred equity remain viable options in a selective financing environment (CBRE).

Why this matters: Selective capital markets reward operators who underwrite conservatively and focus on assets with strong fundamentals, creating opportunities to acquire quality properties at attractive risk-adjusted returns.

Looking ahead: As interest rate volatility eases, capital availability should broaden, supporting increased transaction activity and strategic acquisitions through 2026.

Political & Economic Considerations

Rates Stabilizing: What It Means for Investors

Interest rate moderation is anticipated in 2026 (Cushman & Wakefield), providing greater stability for long-term real estate investments.

While uncertainty remains around fiscal and tax policy, structural housing affordability challenges continue to support renter demand nationwide.

Potential tax and regulatory changes may influence CRE valuations and development feasibility.

Local zoning and land-use policies will continue to shape future supply.

Why this matters: Markets with strong employment growth and population inflows are better positioned to perform across varying economic conditions, even in a moderate-rate environment.

Looking ahead: Policy clarity and rate stability should enhance investor confidence, reinforcing multifamily’s role as a defensive, income-oriented asset class.

Markets Poised for Growth: Wilkinson’s 2026 Focus

Atlanta: Stability and Consistent Rent Growth

Employment growth: Strong, driven by corporate relocations and infrastructure investment

Occupancy: Stabilizing at high levels

Demand drivers: In-migration, diversified economy, relative affordability

Atlanta’s scale and economic diversity support long-term resilience, even during periods of national moderation.

Dallas-Fort Worth: Diversified Growth with Momentum

Employment growth: Robust, supported by corporate expansion and tech-sector activity

Occupancy: Stabilizing as absorption catches up to deliveries

Demand drivers: Steady population inflows and broad-based economic strength

DFW’s diversified economy provides durability, supporting consistent multifamily performance across cycles.

Indianapolis: Value-Oriented Stability

Employment growth: Moderate but stable

Supply pipeline: Limited new construction

Demand drivers: Affordability and strong net absorption

Lower construction pressure and affordability position Indianapolis as a steady, cash-flow-oriented market.

Strategic Positioning: Navigating a Balanced Market

As the multifamily sector moves toward equilibrium, Wilkinson’s strategy emphasizes:

Selective market focus on metros with durable demand drivers

Disciplined underwriting centered on risk-adjusted returns

Active asset management to drive operational efficiencies

Long-term perspective to protect capital while capturing upside

Key Takeaways

Rent growth is positive but moderate, supported by demand and slowing supply

Elevated vacancies are expected to ease as markets stabilize

Capital markets are improving, providing opportunities for strategic investors

Structural affordability pressures continue to support rental demand

Author Notes

The year 2026 marks a transition for multifamily and CRE markets, moving toward equilibrium. Investors with a long-term perspective and disciplined strategy can capitalize on this evolving landscape.

At Wilkinson, our focus on innovative strategies and community-building initiatives are designed to further enhance the appeal of our properties, with a goal of fostering long-term growth and stability in the communities we invest in. With a clear vision and strong operational capabilities, we are well-positioned to thrive in this promising new chapter for multifamily real estate.

Ready to explore passive real estate opportunities? Learn how a diversified multifamily portfolio can become part of your passive investing strategy. Schedule a time to visit with David here: https://wearewilkinson.com/bookdm

About the Author

David McKinney is the Managing Director and EVP of Investor Relations at Wilkinson. With over $2.5 billion in transactions completed during his tenure, David leverages his strategic insights and emotional intelligence to enhance client and team experiences. Beyond his professional endeavors, he is a husband and father, enjoying outdoor adventures in lakes and mountains near his home in Washington State, and he is actively involved in his community as a Rotarian, committee chair advisory board member, reflecting his commitment to leadership and service.

*This does not constitute an offer to sell or the solicitation of an offer to buy securities. Securities may be sold only to accredited investors and only through an offering memorandum. Wilkinson® Corporation is not a law firm, accounting firm, or financial or investment advisor. There is no guarantee that any fund’s objectives, future results, levels of activity, performance, or plans will be achieved. All prospective investors should read the offering memorandum and consult with their own legal, accounting, tax, and financial advisors before deciding to invest.